Import and Export Management (IEM)

Import and Export Management (IEM)

Axional ERP/IEM includes recording, cost allocation, customs duties calculation, and follow-up for import and export processes in the supply chain. Furthermore, it simplifies invoicing related to all the expenses generated by these activities.

It offers your company better control of your inventory along all phases of the import/export process. In addition, you will have at your disposal all information regarding item details and quantities available in each phase of the import process, such as the arrival of goods in the port of origin, a breakdown of container contents, and the bill of lading. Furthermore, you’ll know the scheduled arrival date and the date when goods will be stored in a free zone or free warehouse.

Thanks to this control, you will be able to take quantities and statuses into account in supply planning while they progress through the import cycle from the original order, enhancing accuracy of delivery planning. In this sense, it allows you to anticipate stock levels and eventually assign quantities in advance to sale orders pending delivery.

Having the ability to adapt document flow settings related to import and export processes makes it easier to integrate and manage these processes, minimizes data entry effort, and provides enhanced tracking and followup of the document flow, starting from the initial order(s).

Axional ERP/IEM allows users to not only define the relationships between the documents that confirm each phase of import/export processes, but also break down cost items at each phase and tie them to specific documents for each import/export process.

Axional ERP/IEM will allow you to reduce data entry and maximize the accuracy of cost allocation when performing inventory valuation throughout the various stages of the import process. In each phase, you will be able to report the costs of different invoice items and correspond them to forecasted expenses (in the same currency as they are invoiced). Axional ERP/IEM will automatically create the relevant delivery notes for expenses, based on the same expense grouping criteria each supplier or import/export services provider employs.

Furthermore, you will spend less time updating the expenses of any phase, as you will be able to modify costs in the corresponding settlement documents; the system automatically allocates them to the associated cost evaluation document as well as later documents, as long as these have not been evaluated in a warehouse closing period.

Import documents flow

Axional ERP/IEM takes into account the following entities/phases in the import/export cycle:

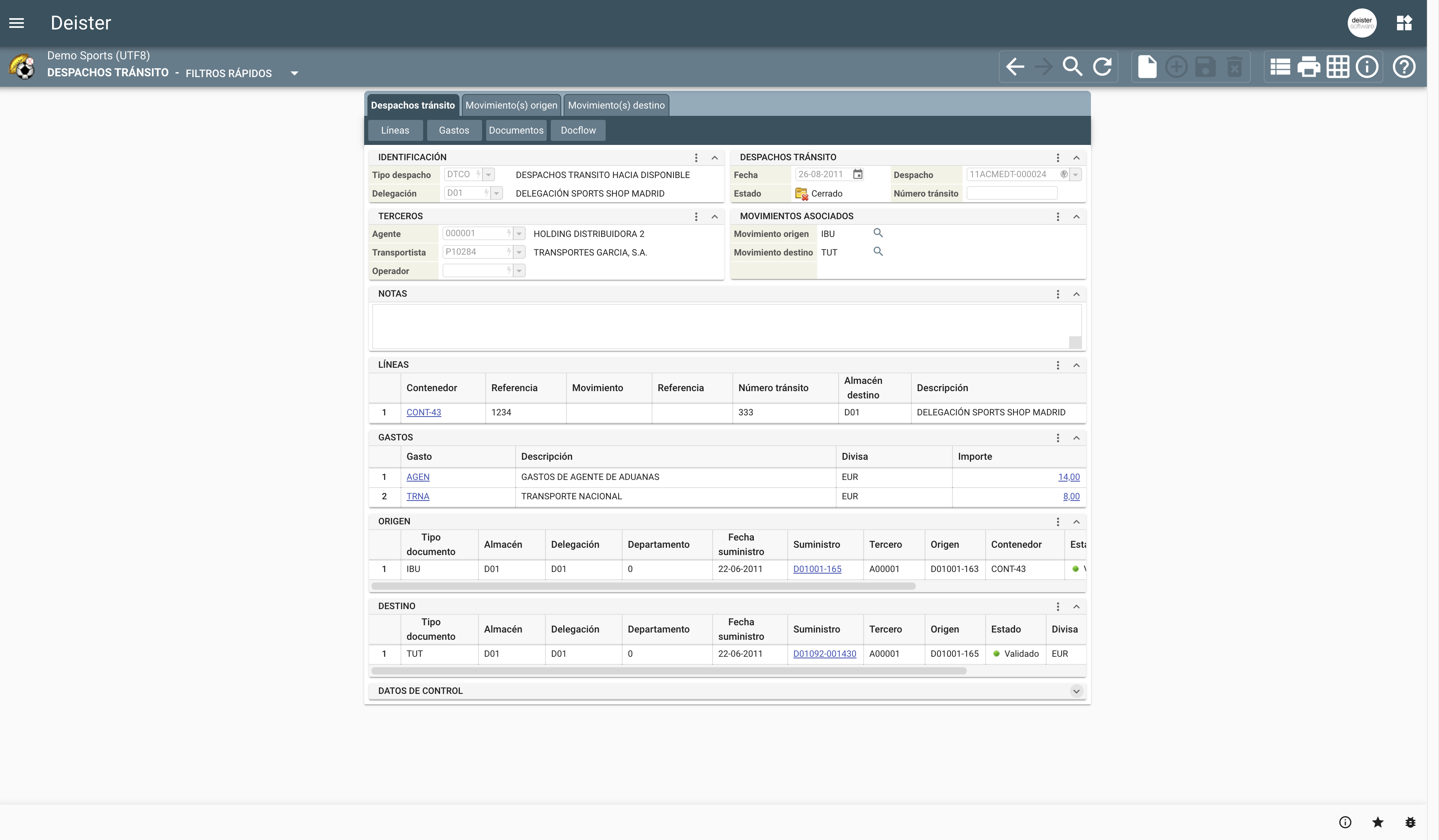

- Dossiers

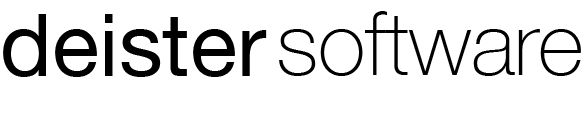

- Breakdown of container contents

- Customs clearance

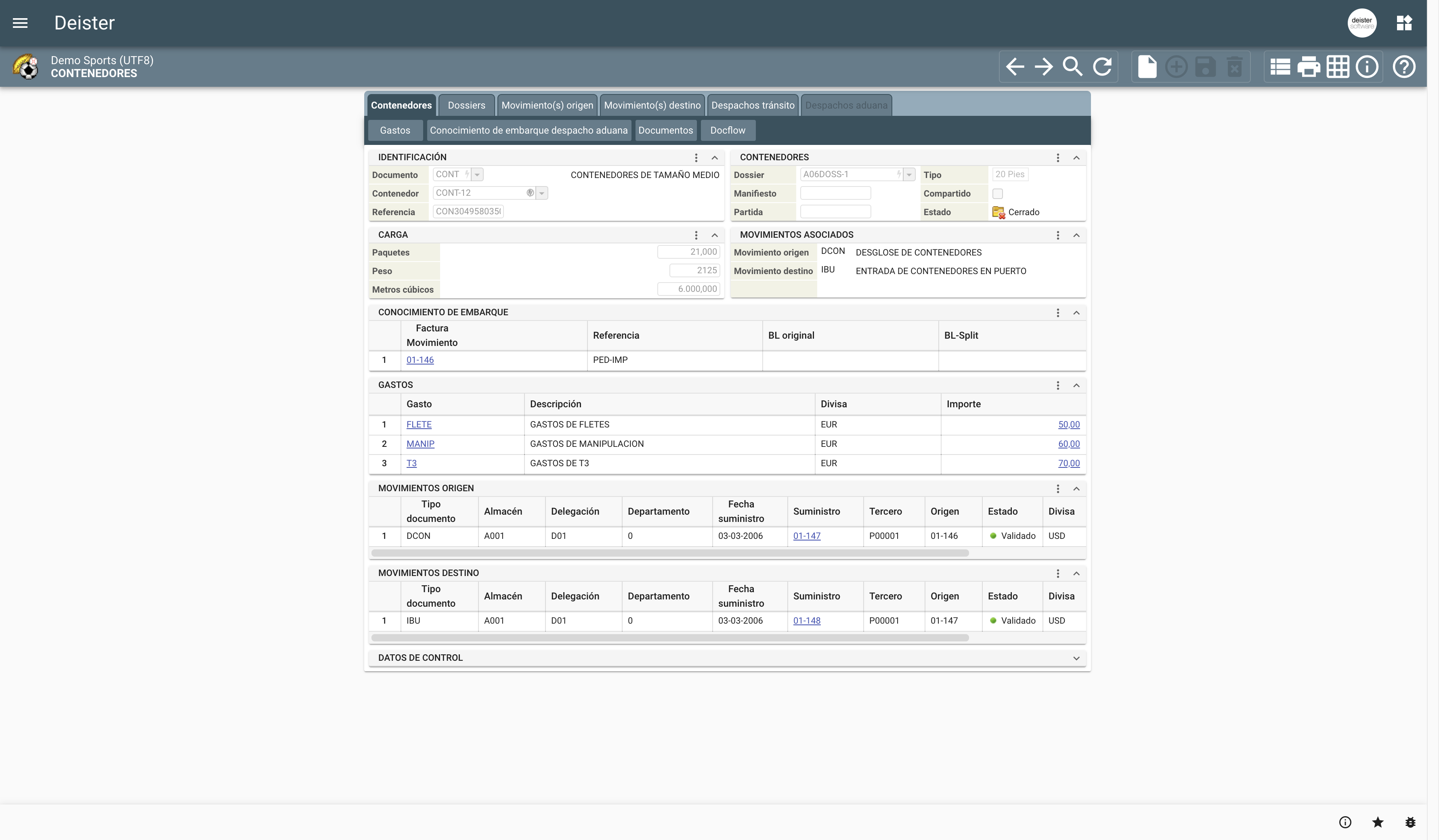

- Transit clearance

By defining the different types of documents for each of these import/export phases, users can also define the corresponding target documents as a result of the closing and confirmation of each successive phase. This feature includes the integration of information from the previous phase into the following one, simplifying and accelerating processes (for example: confirmation of the information which appears in the container contents breakdown vs. information available in the source dossier).

Import expenses

Axional ERP/IEM allows you to set all the expense-related line items which play a role in each of the import phases, and it offers you the ability to set suitable calculation methods for your company. Users even have the ability to set the currency which a supplier must employ, as well as default planned amounts.

In each type of document that plays a part in the import cycle (dossiers, container contents breakdowns, and customs clearance), it is possible to assign many different expense-related items that may apply, with different kinds of algorithms. You can also decide which items will have a role when setting the method used to calculate customs duties.

All cost items which are created in each import phase will be proportionally assigned to each item row of the associated document.

The expenses corresponding to each phase will be successively transferred throughout the import/export process until the goods are finally registered in the company inventory.

The delivery notes of all expenses accrued throughout the process will be automatically generated, adapting the level of detail to the supplier’s system in order to make later invoicing easier (by applying the information gathered in the delivery notes).

Customs clearance and calculation of custom duties

If the company owns warehouses in a Free Zone (FZ), according to the law the company must accurately control the stock available in this warehouse and detail it in a declaration.

The tax administration always assigns a declaration number to a container which arrives in a free zone or warehouse. Afterwards, a part of these goods (also called a shipment) can be stored in a free warehouse or free zone, and all their containers will remain identified by the same declaration number and shipment number. The quantity stored in this warehouse needn’t be moved all at once; it can be divided into smaller parts, declaring a customs clearance amount for each movement.

All these transits through customs clearance must be registered and reported to the tax administration, as well as remaining stock.

CUSTOMS DUTIES CALCULATION

To calculate customs duties when preparing a customs clearance, Axional ERP/IEM takes into account the tariff heading assigned to each specific product (obtained from the tariff heading report — TARIC).

Another factor that companies must take into account when calculating customs duties is the currency which was used to buy the goods (not necessarily the same as in the exchange market). FORM-A certificates of origin can also justify an exemption so that you needn’t pay customs duties, depending on the country of origin and type of product.

Delivery notes are automatically generated with the information from the calculated customs duties. After that, the information from all delivery notes must be compared with the values from the customs agent’s invoice.

Notable benefits

- Reduction of the administrative costs related to import and export management by simplifying and accelerating processes (as many can be automated), such as data transferred through the document flow along the steps in the import/export cycle, and generation and allocation of delivery notes.

- Minimization of manual assignments and automation of expense allocation, reducing the possibility for error and thus improving the quality of information.

- Increase in response capacity for your customers’ orders, as you monitor and plan available stock by integrating the phases of the import process into the company’s supply chain information flow.

- Improvement of the suppliers’ integration into your company’s information processes, which leads to better access to all information in real time. Furthermore, suppliers will enjoy working in a comfortable environment (your website), designed to give the supplier an important role to play in the entire sales/purchase process.

Empower your business today

Our team is ready to offer you the best services