Asset management

Asset management

Axional ERP/FI – Asset Management provides deep insight and monitoring on your investments in equipment or other non-current assets, while managing both financial information and enhancements on your company’s fixed assets with an affordable, easy-to-use approach.

This module is equipped to deal with multi-company and multi-site environments, deploying a wide range of dimensional and analytical drivers. The information structure includes several degrees of categorization, such as type of fixed asset, group, location, or business unit, as well as accounting methods associated with the asset.

It also provides information on the investment, depreciated and appreciated amounts, amortization schedules, managers responsible for the asset, supplier invoice or delivery note, and all other information required for administrative control.

System capabilities provide easy tools to manage periodic depreciation, asset impairment, revaluation, and write-off, etc., detailed on an asset or sub-asset basis. Moreover, accounting data is linked to its source record in the assets module, taking advantage of the core integration between modules.

The solution provides automated features to set up reports and manage critical information, maintaining full tracking of all your assets and managing your resources in the most efficient way to answer the specific needs of your company.

Oversight is maintained on critical information, with a full overview of asset files and their financial evolution. This information is complemented with multidimensional insight on assets recently acquired, updated, or transferred.

Axional ERP/FI-AM does not limit how your company can operate. It adapts to your business processes by providing a wide range of flexible, full web tools. Among them are the accounting interfaces that enable you to schedule bookkeeping according to your methodology, or the ability to flexibly analyze hypothetical depreciation situations with a variety of methods, e.g. for investment valuation purposes.

It also includes multiple types of records, assets, and resource allocation tracking to ensure effective, comprehensive and flexible features that will not become obsolete.

Other features are provided in order to enhance your internal productivity, such as resource templates, depreciation calendars, monitoring systems, KPIs and fully-customizable oversight tools. Additional processes are also available to assist you in consolidation scenarios. Solid functionalities in this area allow you to plan for corporate holdings and mergers.

No matter what your company’s unique requirements may be, Axional ERP/FI-AM is ready to succeed, providing all the tools necessary for reliable management, reporting and oversight.

Some of the advantages provided by the solution are the following:

- Creates, modifies and controls data for each fixed asset. Master data includes information such as date of purchase, date of activation, type of asset, order and invoice number, supplier, point of contact, location, original purchase price, and depreciation system.

- Fits company-specific asset management needs, with appropriate reports suited to different business environments.

- Fully controls your property values including depreciated capital, whether the asset is PPE, right-of-use, etc.

- Supports the automatic accounting of fixed asset disposal, impairments, and periodic depreciation. These operations can be performed at any time regardless of accounting period or status of asset depreciation.

- Core integrated with the Axional ERP/FI – General Ledger module, which provides accounting entries for new investments, disposals, write-off and asset improvements or impairments.

- Fully integrated with purchasing and the Axional CMMS maintenance modules, which allows the automatic creation of fixed asset management data from the purchase cycle, also handling extra costs and revaluations as a result of maintenance.

- Assets are allocated to specific cost centers and analytical entities, allowing automatic integration with the cost accounting model defined by the company.

- Multiple improvements can be linked to each asset, which may or may not inherit their parent assets’ features related to depreciation and revaluation.

- Breakdown of different types of investment value (cost of acquisition, improvements, revaluations, impairments and adjustments).

- The monthly depreciation of an asset group can be updated at a specific time, while related accounting entries are booked in the General Ledger Account.

- All processes can be rolled forward and rolled back, with no accompanying loss of information. For example, depreciation already calculated and accounted may be rolled back, then rolled forward again after several data points have been adjusted.

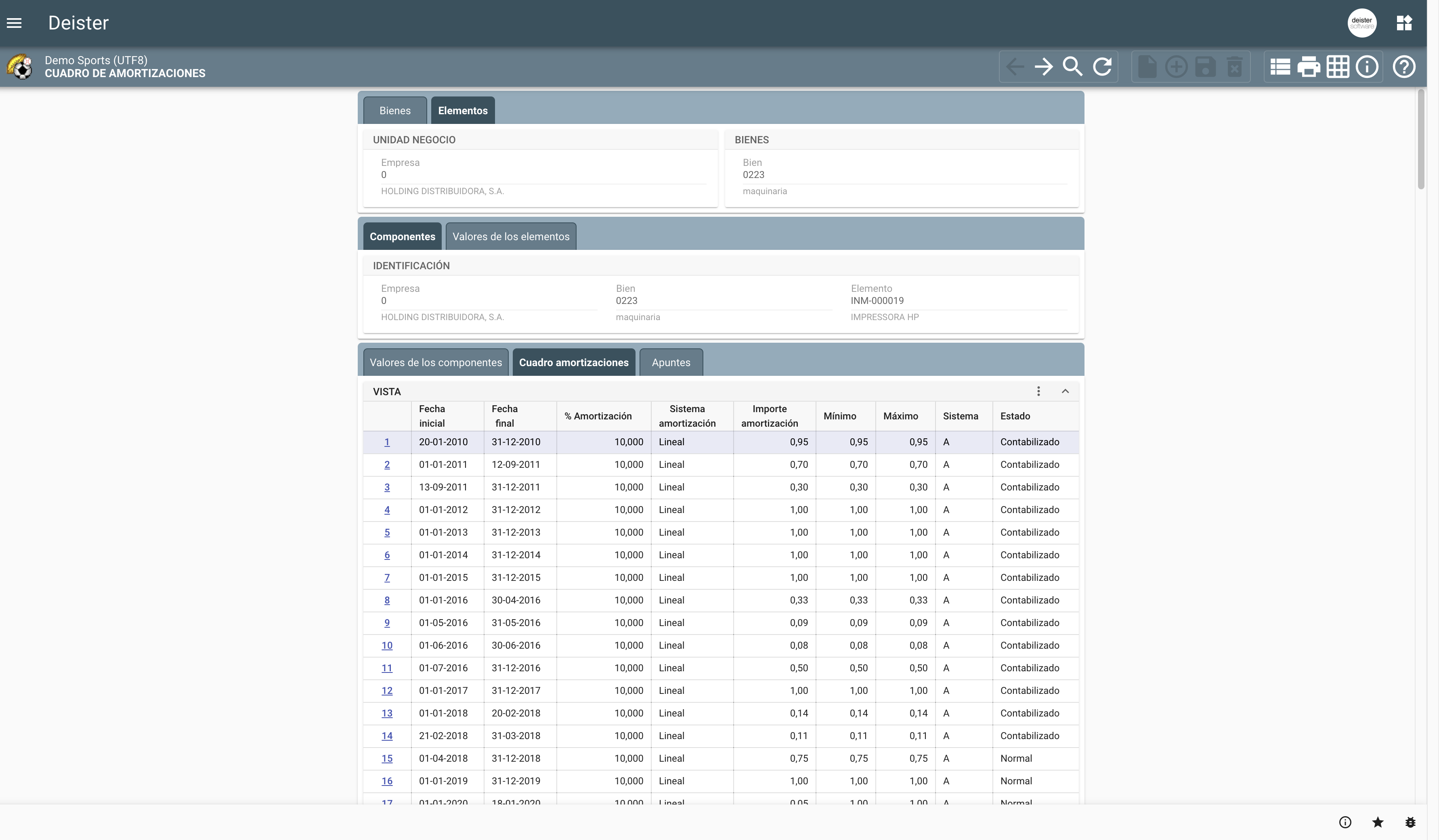

- Full overview of depreciation schedules and asset value evolution. Key facts and figures can be accessed at any moment: depreciation conditions, revaluations and impairments, accrual, net value, and life cycle improvements.

- Strong security features throughout the module. Record input is always tagged with user and timestamp info, while any modification or update will also display the user responsible and timestamp.

- Multi-site, multi-company and multimodal features to deal with several assets or accounting ledgers at once.

Data model

The concepts related to the fixed asset data model are:

- Flexible pyramidal structure

- Investment value concepts

- Location

- Accounting / Accounting groups

Assets can be defined within a flexible hierarchical structure, grouping criteria in multiple levels while linking each one to specific sets of shared master data. The result is an adaptive asset structure that can suit any business model.

Breakdowns are available for each type of fixed asset valuation: cost of purchase, financial cost, gains on improvement or maintenance, gains on balance sheet revaluation, impairments, and partial write-off.

The module also provides the ability to associate several improvements with each asset; these improvements may or may not inherit the original’s characteristics for depreciation calculation and revaluation purposes.

The inventory of fixed assets is built to make the asset location needs of complex businesses easy, with several branches and a large list of investments. Here, concepts like location and sub-location help to clearly identify an asset’s physical placement via serial and document numbers provided in the Asset Management module.

Includes multiple methods and options to account for fixed asset operations in the General Ledger. Operations include depreciation, new investment, write-off, write-down, partial disposal, or sale, allowing high-level flexibility tied to your accounting model.

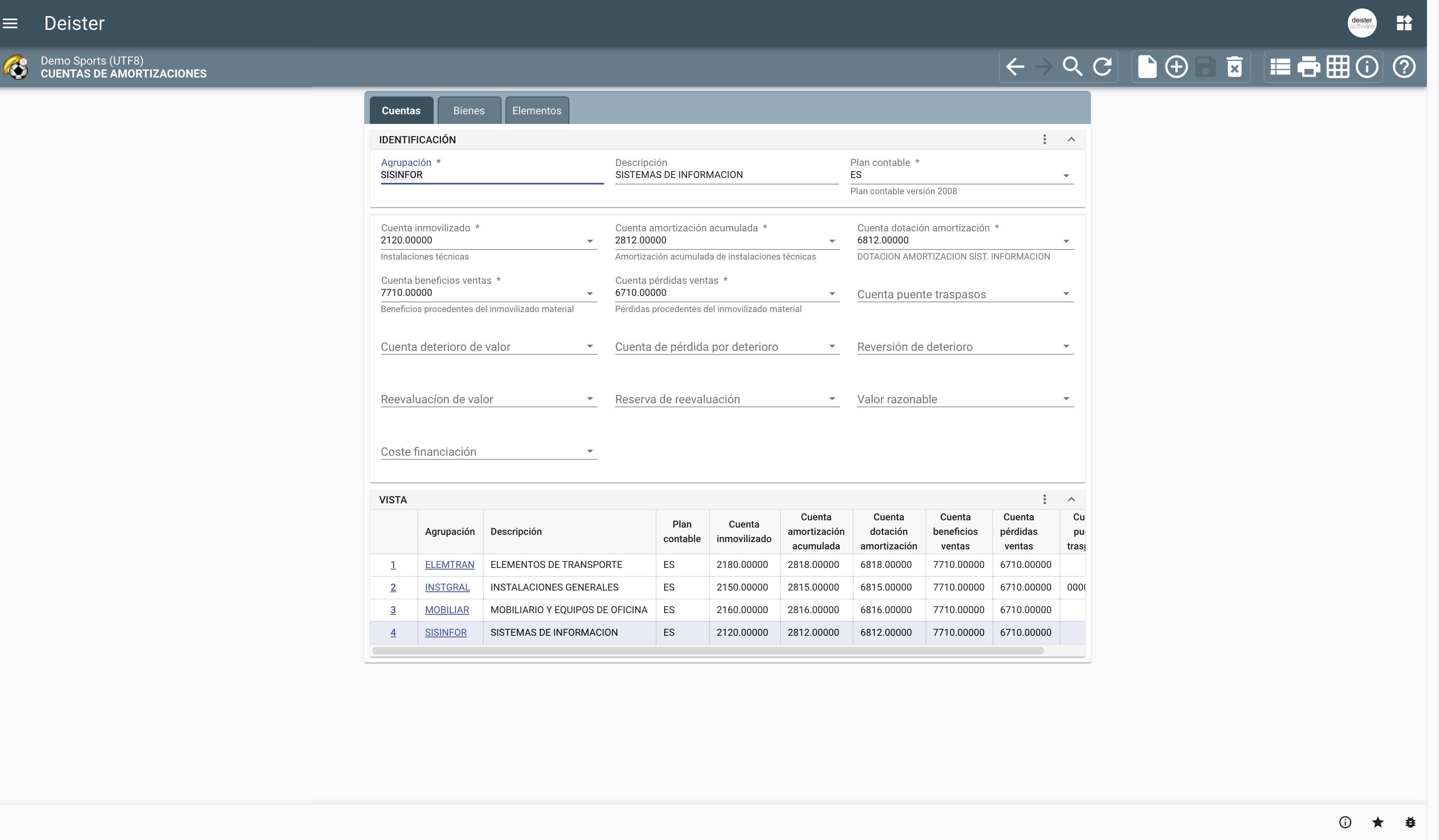

Groups of Accounts

The master data for assets is equipped to handle groups of general ledger accounts. Their definitions will be connected to individual assets or groups of assets.

Likewise, the hierarchical approach to the fixed asset structure allows us to replicate these groups’ settings and deploy accounting schedules for lower levels of the structure.

In this sense, the mimetic allocation of predefined accounting master data, from top-level asset groups to individual items and components, results in powerful depreciation-related accounting transaction capabilities.

Furthermore, defining accounts at the topmost asset group level maintains the consistency of accounting transactions connected to items or components (fixed asset sale, disposal, write-off, and partial write-off). Extraordinary gains or losses will be reflected in general ledger accounts preset for an entire asset group.

Processes on assets

Axional ERP/FI – Asset Management automates all operations with accounting reflection on fixed assets.

Depreciation Method

Several forms of depreciation can be defined according to legal framework or company guidelines. Subsequently, each item can be linked to the appropriate code and to a variety of depreciation methods. If an item has multiple applicable forms of depreciation, multiple depreciation books will be kept for accounting and analysis according to company requirements.

Depreciation Tables

Each asset has its depreciation table and improvement values scheduled for the entirety of its life cycle. This allows users to check all relevant forecasted figures, depreciation and revaluation rules, and accumulated amounts, automatically maintaining a record of past depreciations according to the asset investments, disposals, and sales on record.

Automatic Depreciation Accounting

The Asset Management module employs a specific process which generates accounting entries to record figures for each depreciation period.

Accounting entries are deployed according to groups of accounts for each category of fixed assets. These can be extrapolated, if a different group is not assigned, to each asset component, dividing accounting records by desired level of detail.

Other depreciation features

Axional ERP/FI – Assets Management has the following functionalities for automated support on depreciation:

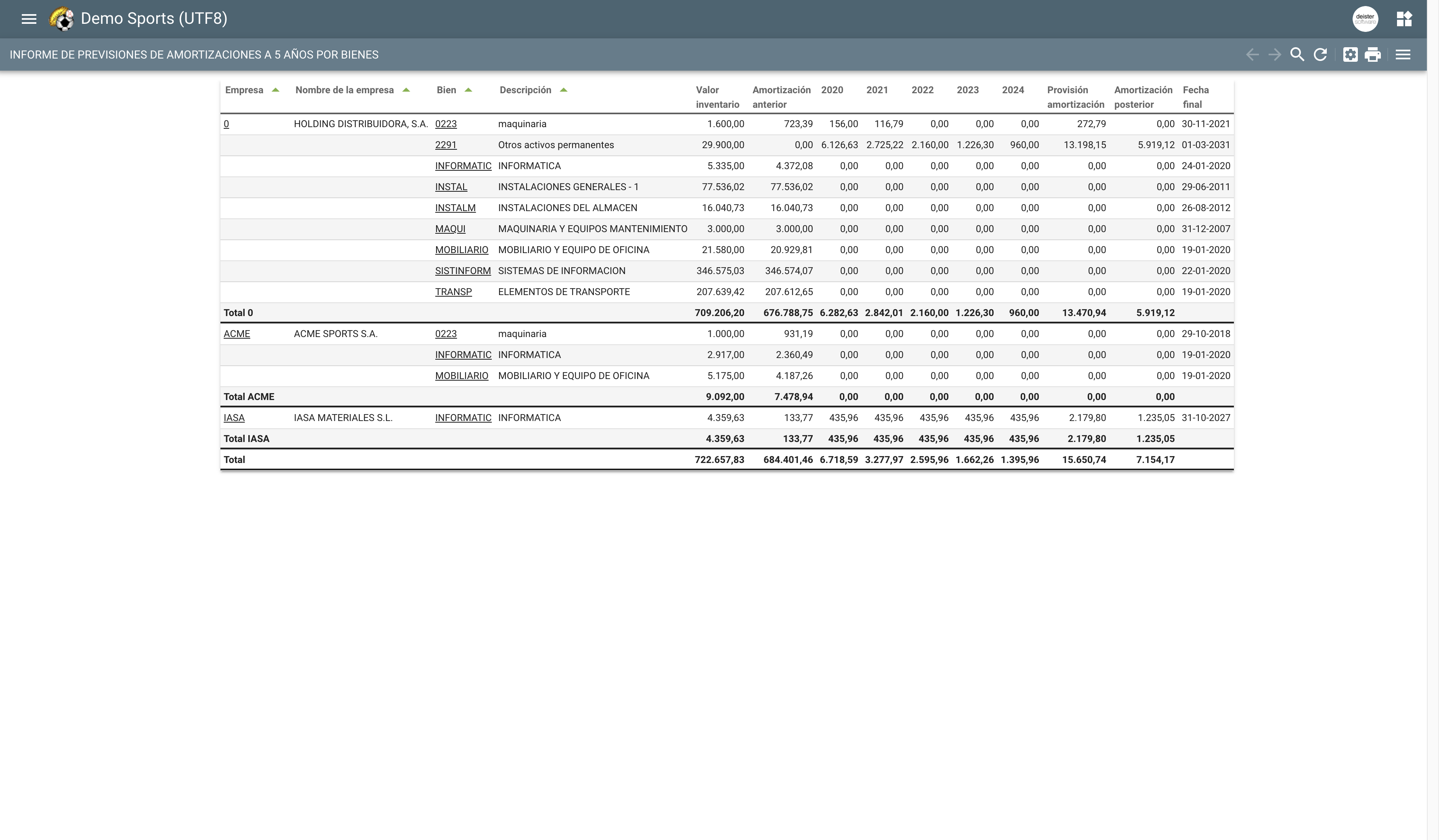

- Depreciation Expense Forecast.

- Depreciation Simulation.

- Change of Depreciation Rates.

The asset transfer process allows companies to allocate items from their original asset group to a new destination. This involves the adjustment of various aspects: the parent asset code, group of general ledger accounts, analytical dimensions like Project, Section, Cost Center and so on, and other ancillary data. The final result deploys automatic records in the General Ledger module that reflect all changes made in the Asset Management module.

Sometimes, it is necessary to divide an asset into multiple new components that will evolve according to independent criteria. This division can be produced by splitting the original either by percentage or by net cost. According to this calculation, new asset components will replace the original while proportionally maintaining initial value, depreciation table, and schedule.

Reports

The module provides several reports according to management needs, allowing you to effectively manage and monitor fixed assets in different business environments. The data model ensures fast access to reliable, scalable information for reports on both simple and complex queries. Main data will show:

- New components

- Total non-current assets

- Investments or purchases from one or more fiscal years: By general ledger account or location

- Asset writ-off, disposal, partial sales, and residual values

- Groups of assets, current-year investment, accumulated depreciation, year-over-year evolution, inventory

- Projected depreciation expenses, useful when building budgets and forecasts

- Cutting-edge reporting focused on safe managerial decision-making

- Wide range of standard oversight reports on property, taxes, capital investment and other critical info

- Full drill-down, drill-through browsing and search tools, delivering detailed, trackable insight

Notable benefits

- Physical and financial monitoring of company investments. Analysis of investment profitability involves strong oversight.

- Corporate Income Tax (CIT) optimization through depreciation rules. Depreciation tables manage minimum and maximum rate boundaries. Simulations within these ranges will return the best scenarios according to tax and financial conditions.

- Decision-making about the suitability of balance sheet revaluation legislation. Sometimes these revaluations are permitted in conjunction with certain tax payments. This tool provides reliable data to evaluate the payoff linked to this obligatory cash-out.

- More efficient use of time and human resources related to the management of fixed assets.

- Simple tools and features use automatic process flows to reduce the organizational burden of fixed assets.

- User-friendly interface built to minimize the complexity of the deployment cycle.

- Well-designed security features which enable selective access to several information areas. Filters are available to expand or hide sets of data, provide default values, and prevent human error.

Empower your business today

Our team is ready to offer you the best services