Tax Management

Tax Management

Axional ERP/Finance – Taxes deals with all kinds of transactions involving taxes, VAT, withholding or deductions, settling with the relevant administration. In this sense, the solution:

- Analyzes and considers all features surrounding business transactions to automatically assign types of taxes onto products or services purchased by the company.

- Provides all the tools necessary to manage, organize and issue tax assessments.

Axional ERP/FI – Taxes supports a wide range of tax scenarios with multilevel tax structures and multiple fiscal authorities. The master data definition has been designed flexibly enough to cover any tax scenario in which transactions recorded in the system are realized.

The core functionality deploys tools and features required for full recording, management and filing of corporate tax, personal income tax, VAT, GST, etc., as well as INTRASTAT statistics.

Tax zone

Axional ERP / Finance – Taxes uses the concept of tax zones to facilitate the automatic assignment of types of taxes on purchased or billed products and services.

The definition of tax zones is flexible, and their purpose is to obtain the type or types of taxes applicable on a business transaction, as well as its fiscal scope, through a mnemonic code for classification. This categorization is obtained according to the source and destination of the transaction, as well as both the type of good or service involved and the nature of business partners. As a result, a specific mnemonic code will be assigned to represent the fiscal scope of the transaction.

Axional ERP / Finances – Taxes allows to link the Tax Zone assigned to the fiscal area where the company (branch, business unit, or commercial address) operates with the business partner’s Tax Zone. This is done according to both the origin and delivery addresses, either in a purchase or sale.

For each transaction line, tax rates and applicable operations are allocated, depending on:

- Tax zones, both source and destination.

- The nature of the transaction, either purchase or sale.

- Whether goods or services are involved.

- Whether the operation is on debit or credit.

- Whether the type of tax is VAT/GTS or withholding .

Mixed scenarios are allowed for each individual line, and also for each document as a whole.

This infrastructure allows companies to, for example, stay compliant with specific legislation, for instance, special EU areas (Canary Islands, Ceuta and Melilla, Lugano Lake, French overseas departments), EU domestic areas (Spain, Denmark, Italy, etc.), and cross-border EU transactions. Trade outside the EU, duty-free areas and so on are also supported.

Tax records

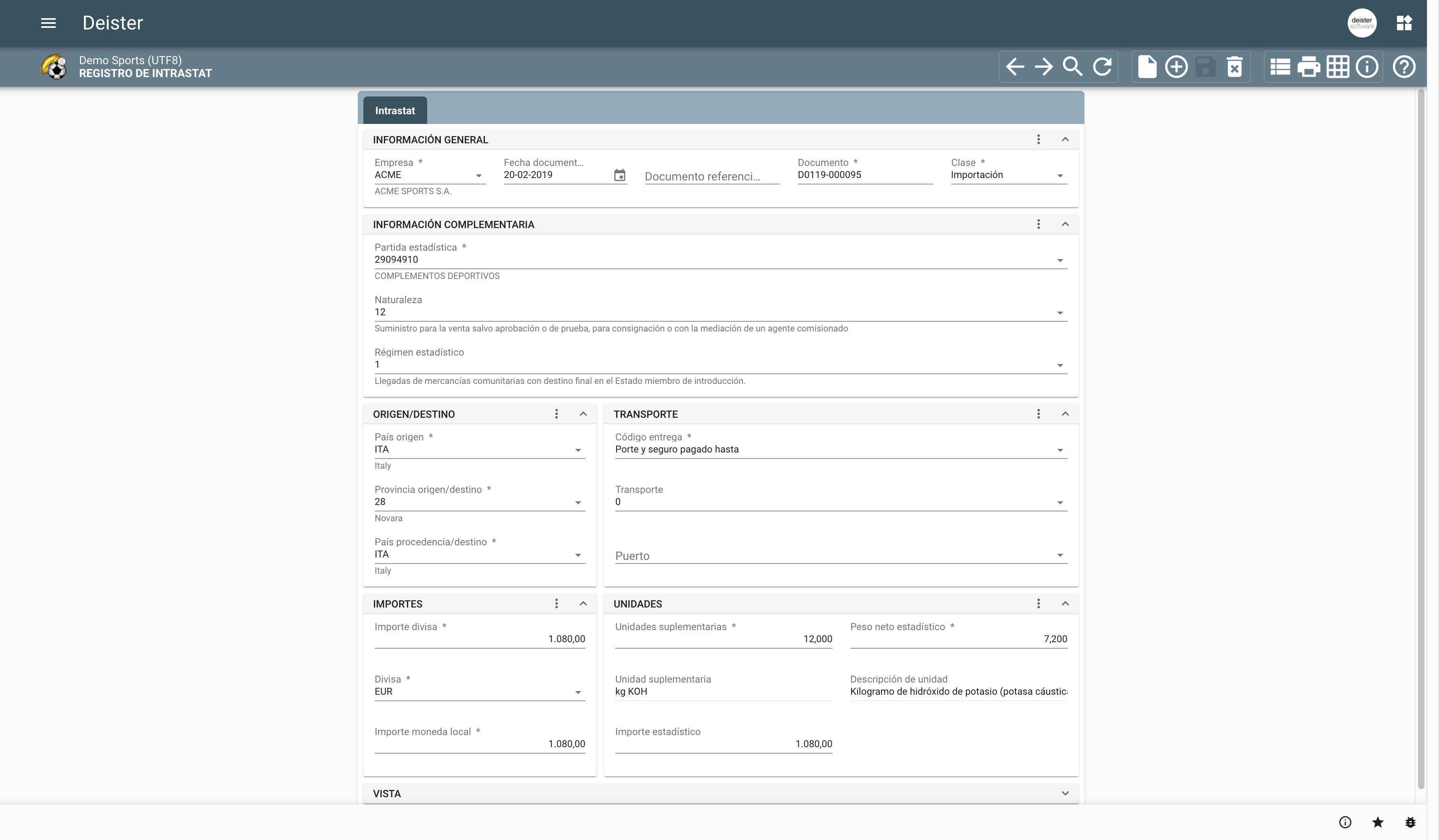

Tax records are specially designed to ease the preparation of official models for tax filing. Tax filing and preparation models are adaptable to the requirements of any country, related both to VAT/GST and withholding taxes, based on the type of operation or transaction in question, the source and destination tax zone, and the type of goods and services acquired or sold by the company.

Tax record definition is flexible, only requiring that users report the mnemonic code of the type of operation associated with the records needed to create reports or statements.

VAT and taxes in a pro rata system

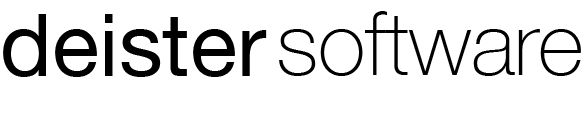

Axional ERP/Finance – Taxes allows you to set up tax code types by defining whether they are fully deductible, partially deductible (by a percentage), or non-deductible.

Based on this percentage, invoice accounting processes eventually accumulate according to the non-deductible portion of the rate and the amount assigned to purchase or expense accounts for the corresponding accounting entry, generating items in the VAT account input by the deductible portion.

This percentage also encompasses the handling of cases where VAT/GST is applied according to both general prorated and special prorated tax rules.

VAT/GST Validation

Axional ERP/Finance – Taxes allows the application of the cash criterion in the settlement of value added tax (VAT). This functionality acquires special relevance in certain countries or sectors. It also allows the accrual and cash criteria to coexist, if necessary, for the same company.

Withholding tax

- Controlling income tax withholding amounts applied to suppliers of services under legal regulations.

- Providing solutions for legal exceptions, special deals and fixed periods, e.g. possible withholding amounts for professionals in their first year of business.

- Registering special withholding taxes for certain commodities, rent, professional services, and so on.

- Issuing legal models and electronic files connected to this kind of filing.

EU and international transactions

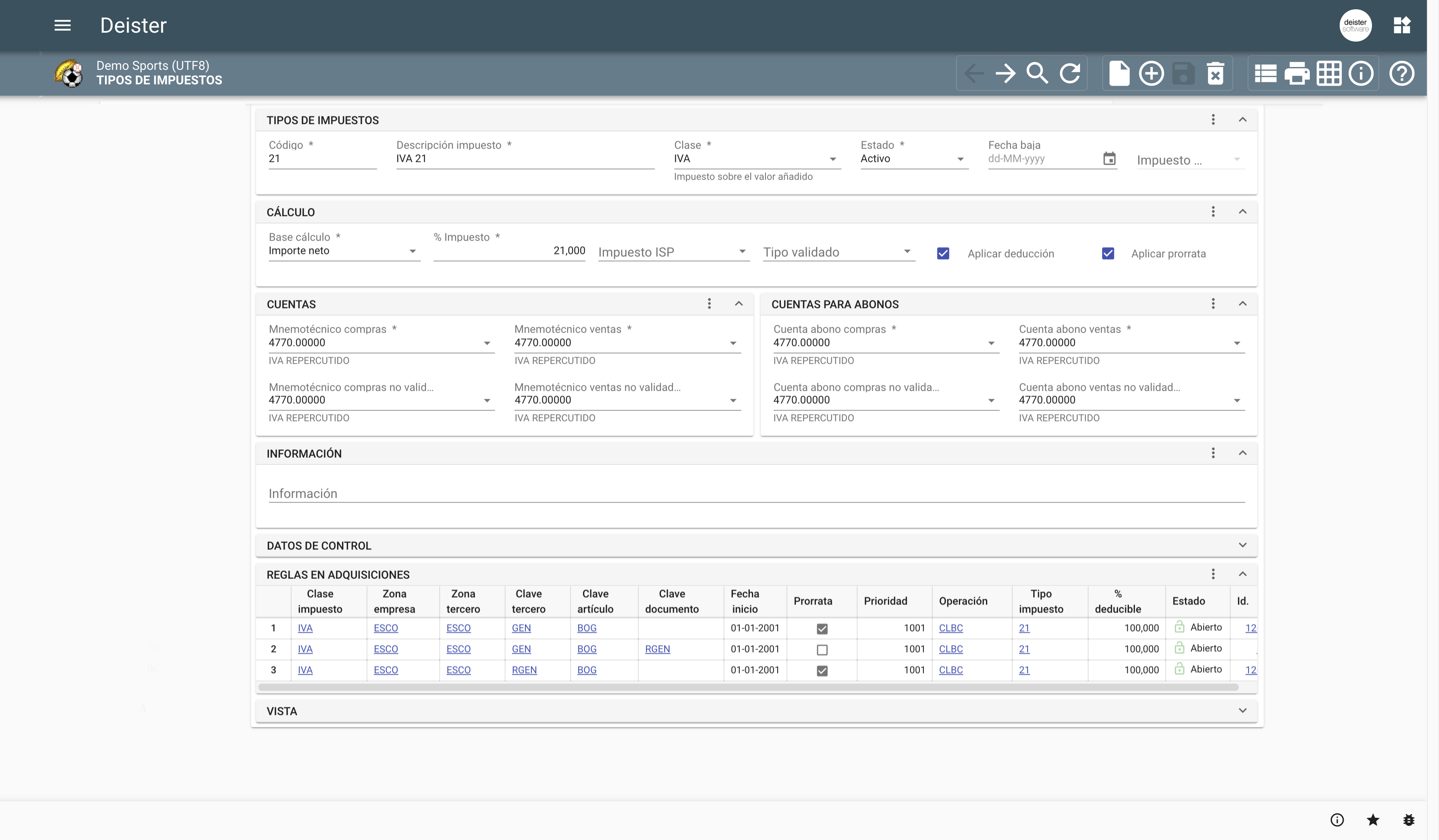

Axional ERP/Finance – Taxes allows you to file VAT statements related to customs clearance procedures. According to the Incoterm beneath the commercial agreement, customs agents will calculate VAT on net amounts different from the one consigned in the original invoice.

For instance, CIF agreements will be handled by adding other costs such as transportation and insurance to the net base amount before the customs agent calculates the VAT. This will be the net base amount and VAT amount recorded for formal tax filing.

Self-Invoicing

The current VAT standardization within the EU is based on the principle that taxes on EU transactions should be accrued and deducted on delivery.

In order to be compliant with this legal framework, Axional ERP/Finance – Taxes identifies tax operations in which third parties belonging to EU countries participate, which means taking into account the location of the company and its business partner, selecting the appropriate level (headquarters, business unit, branch, subsidiary) and the country of the source and destination addresses. Afterwards, the EU transaction process will register tax entries with input and output tax, tagging these lines as Self-Invoices issued and received, respectively.

Intrastat

Axional ERP/Finance – Taxes provides a set of features in order to manage customs requirements regarding statistical information on the exchange of goods in trade operations between EU countries, facilitating Intrastat declarations and the issuing of electronic files, according to current regulations.

Triangular Operations

Regarding triangular operations within EU borders, each transaction is categorized and tagged in order to provide the information needed to fulfill required tax declarations (for instance, Spain’s M-349 model).

Document issuing

Axional ERP/Finance – Taxes provides a wide range of functionalities to address the preparation of tax statements, declarations, and fiscal electronic files and certificates. Tax settlement processes and similar requirements are also automatized.

All processes are intended to deploy reliable data on a real-time basis and simultaneously minimize the administrative burden of tax management.

This set of statements and filing covers:

- VAT/GTS declarations.

- Withholding statements.

- Invoice bookkeeping.

- Other taxes or declarations.

- Certificates, e.g. withholding certificates.

- Electronic filing adaptable to various government administration frameworks. Spanish taxation covers electronic files for 115, 180, 190 and 210.

- Fiscal periods defined and managed independently from accounting periods once tax settlement has occurred, thus avoiding data manipulation after taxes are settled.

Notable benefits

Axional ERP/Finance – Taxes brings your enterprise solutions with real key benefits, as summarized below:

- Rapidly-adapting features aligning your business with continuously-evolving tax legislation, thanks to its flexible and sturdy tax data model.

- Fully reliable, user-friendly approach to your tax figures. Supports all audit processes, facilitating full tracking, drill-down, and drill-through tools.

Empower your business today

Our team is ready to offer you the best services