Treasury

Treasury

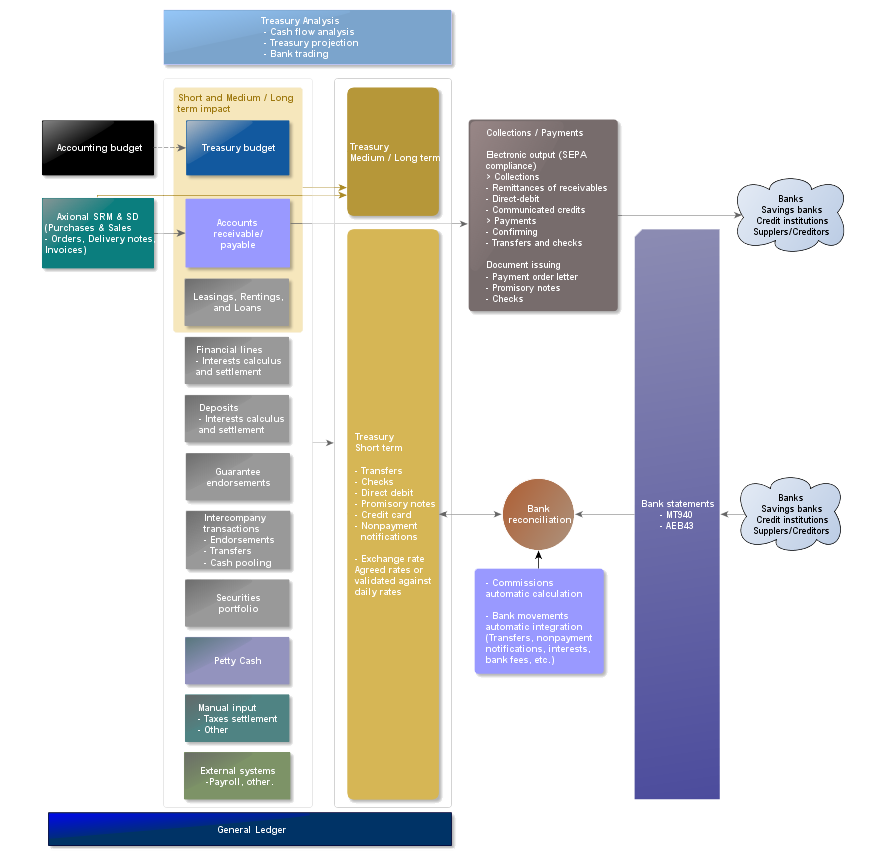

Axional ERP/Finance – Treasury provides support for all kinds of cash flow operations, optimizing both short- and long-term decision-making on liquidity and strategic cash planning.

Axional ERP’s treasury management brings solid features to oversee cash flow distributed among various bank accounts and entities, integrate bank statements, and automate reconciliation of bank statements with projections by means of configurable rules. This big-picture approach to cash flow requirements allows full control over financial operations and calculations, as well as continuous monitoring of deviations from expectations.

Axional ERP/Finance – Treasury is bound to and integrated with other modules to ensure consistence between areas of the company, with shared data flowing throughout the system. For instance, the company’s short and medium-term financial position is updated on a real-time, constant basis thanks to core integration between modules.

Furthermore, some key features are underlined below:

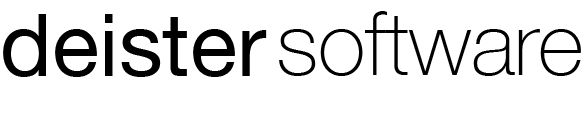

- Definition, handling and reconciliation of accounts in any currency, with monitoring of banking terms and conditions such as period of validity, commissions and fees.

- Cash flow budgets and medium-term cash forecasts.

- Automation of cash-in and cash-out processes: collections, payments, electronic banking, settlement and bookkeeping.

- Automatic generation of cash forecasts and liquidity projections.

- Oversight and reporting of expected banking conditions versus real costs of each bank account contract.

- Cash budget. Provides strong short-term and medium-term oversight on liquidity and cash flow at both, allowing companies to record cash forecasts.

- Electronic banking management. Full cycle of communications with electronic files linked to banking operations.

Integration with Axional ERP/FI

Axional ERP/FI – Treasury deals with all kinds of information connected to the cash flow cycle and management. One of its main focuses is to manage bank reconciliation and settlement while providing high-level control of bank balance amounts. To ensure this critical point, the module builds a wide repository of cash transactions reflecting all cash operations.

Cash transactions can be fed from multiple features within this area (cash flow budget, leasing, loans, direct integration from bank statement) or even from additional automated records from other areas of the business.

Below is a list of some Axional ERP/FI modules connected to Axional ERP/FI – Treasury in order to build the best possible real-time view of the short-term cash forecast. They take advantage of Treasury Register records as a central location where receivable or payable amounts are deployed according to collection or payment orders in ACR/ACP portfolio management, revenue transactions from retail accounting (cash, credit card, checks, transfers, etc.), investment portfolio operations, or external systems’ records.

- General Ledger Account

- ACR/ACP

- Retail

- Investment Management

- External Systems

Several sources within Axional ERP/FI – Treasury are also connected:

- Manual transactions, e.g. monthly payroll payments.

- Bank statements. Records automatically generated after the reconciliation process.

- Cash budget.

- Leasing, renting and loans.

- Bank guarantees.

- Petty cash.

The integration of Axional ERP/FI – Treasury goes beyond the forecasting required for bank reconciliation and settlement. Core connection to Axional ERP/FI – ACR/ ACP ensures automatic notification and status updates (bill collected, collection with bank risk, payment ordered, etc.) according to management process loops, as well as the linked accounting of the receivables/payables portfolio with each corresponding cash flow transaction:

- Notification of orders from Axional ERP/FI – ACR / ACP. For example, when an order to transfer payment is issued, one cash transaction may settle several notes payable connected to a supplier. When reconciled with the bank statement, all related notes payable will have their status updated according to projections in the debt payment loop from which the order was emitted.

- ACR/ACP notes linked directly with cash flow records, e.g. the case of defaulted payments, where receivables past their due date will be highlighted by the bank to notify the company.

After this reconciliation, accounting will subsequently settle cash flow movements. For example, a payment transfer to a supplier will decrease the balance of the underlying ledger account, and the balance in the supplier’s ledger account will also shift to match.

This process ensures the integrity of information regarding:

- Bank statement balance vs. general ledger account balance

- Supplier’s general ledger account balance versus supplier’s portfolio balance

Incorporation of bank statements

Axional ERP/FI – Treasury has a central repository of bank statement files which automatically converts information into bank statement transactions, ready to be reconciled with the company’s cash flow transactions.

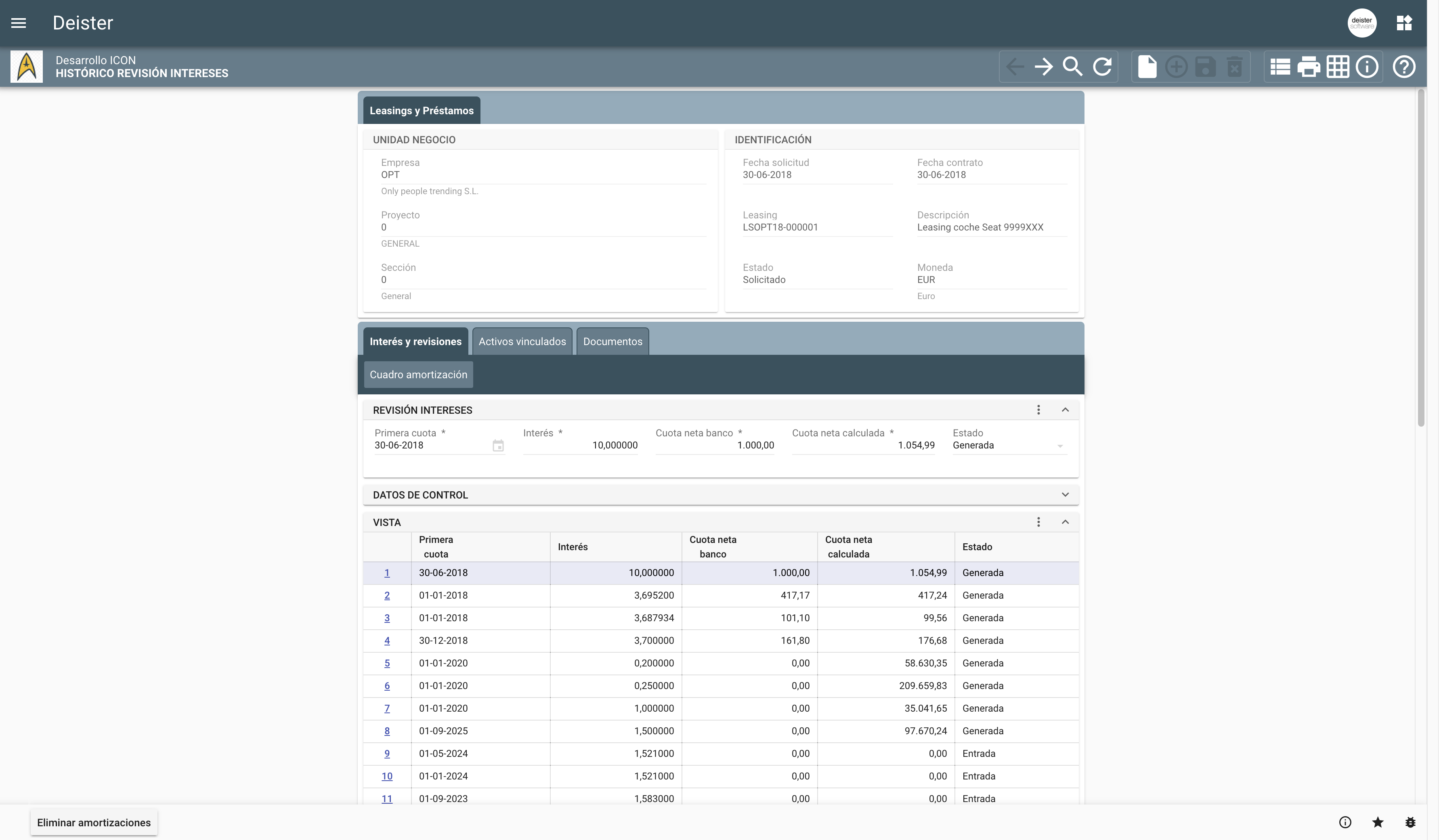

All specific attributes that characterize a bank statement transaction are identified, among them the transaction description. To create said descriptions, for example ‘sweep account’ or ‘transfer’, users can configure the automatic generation of company treasury transactions, allowing Axional ERP/FI to match bank activity to them.

Bank reconciliation

Axional ERP/FI – Treasury provides a simple but powerful way to record and reconcile day-to-day bank statements. Regardless of the number of active bank contracts a company possesses, the system provides both general and customizable rules in order to reconcile daily bank transactions. Rules can be defined for each type of financial operation, contract, transaction code, and so one. The system then evaluates incoming electronic data in the bank statement table against outstanding records pending reconciliation, stored within the main Treasury repository.

Bank reconciliation will not always proceed without user input. Special attention and setup is required for the following cases:

- If amounts do not coincide, but the margin of difference is permissible and other conditions are fulfilled. In this case, the option exists to accept and record the deviation with a line in that reconciliation batch.

- If there is no treasury record that matches the incoming bank statement, the option exists to automatically generate a record. This may occur according to presets for specific bank accounts or operations, or by manual user input.

- If bank transactions and company treasury transactions pending reconciliation do not match one-to-one, or some reconciliation rules are not met. In this case, the system deploys easy-to-manage tools for ‘selective multiple reconciliation’. An intuitive screen allows the user to select specific transactions and click to run the reconciliation process.

Bank accounts

The calendars specify the operating hours and holiday schedule of each bank entity, branch and office. They are checked in order to calculate dates of validity for treasury transactions.

Axional ERP/FI – Treasury allows the automated calculation of bank commissions. This facilitates the forecasting of which commissions and fees should be charged for each bank account or contract, considering the nature of each operation, the company’s financial position and so on. Afterwards, reports will compare these forecasted fees against the real values on electronic bank statements.

Axional ERP/FI – Treasury is equipped to calculate commissions and fees according to their conditions and predefined rules, whether applied to the original entry or through the creation of a complementary entry. These amounts are based on rules which consider percentage-based fees, minimum fee, fixed fee, and so on. Grouping criteria will also play a role in determining amounts (commissions on entire transaction amount, by standalone bill, etc.) or bill aggregation (commission by number of notes receivable or payable, by recipients, etc.).

Banking business controls

Axional ERP / FI – Treasury collects and structures information for ample control over the company’s financial services providers. It encompasses analysis of the following areas:

- Volume and cost of banking business.

- Commissions and fees on accounts and transactions.

- Differences in the application of trade dates and valuation dates.

- Differences between expected and actual bank commissions and fees.

- Settlements of interest on bank accounts. Fixed interest rates with dates in effect, interest rates indexed to financial markets, differential rates, calculation of annual percentage rates (APR and EAR), as per bank or company approach.

Specific functions

Axional ERP/FI – Treasury identifies the eventual sources and destinations for each cash inflow or outflow, just deploying the a concept of treasury cash flow codes. This codification makes easy to analyze inflows and outflows from a cash approach, and also to provide deep detailed information not only about current liquidity, but also looking at historical past situations and forecast forthcoming scenarios.

Cash flows can reflect sources and applications of income and expenses in currencies other than the currency of the financial account, with the assigned exchange rate being flexible.

The same cash flow can include different flows of different currencies. If, for example, the currency of the financial account is EUR, a transfer is made in USD, and the transaction has a commission associated with it, the latter will normally be applied in EUR, even if the transfer corresponds to another currency. Thus, it is the sum of the amount of the cash flow in the currency of the account that constitutes the amount of the cash flow.

The Treasury cash budget is a flexible tool designed to provide strong monitoring capabilities and budget oversight over the real-time evolution of treasury operations. It also simultaneously provides a basis to keep the medium-term cash position forecast updated.

It is possible to record transactions by: date of realization, bank account, cash flow segmentation, budget line description or currency.

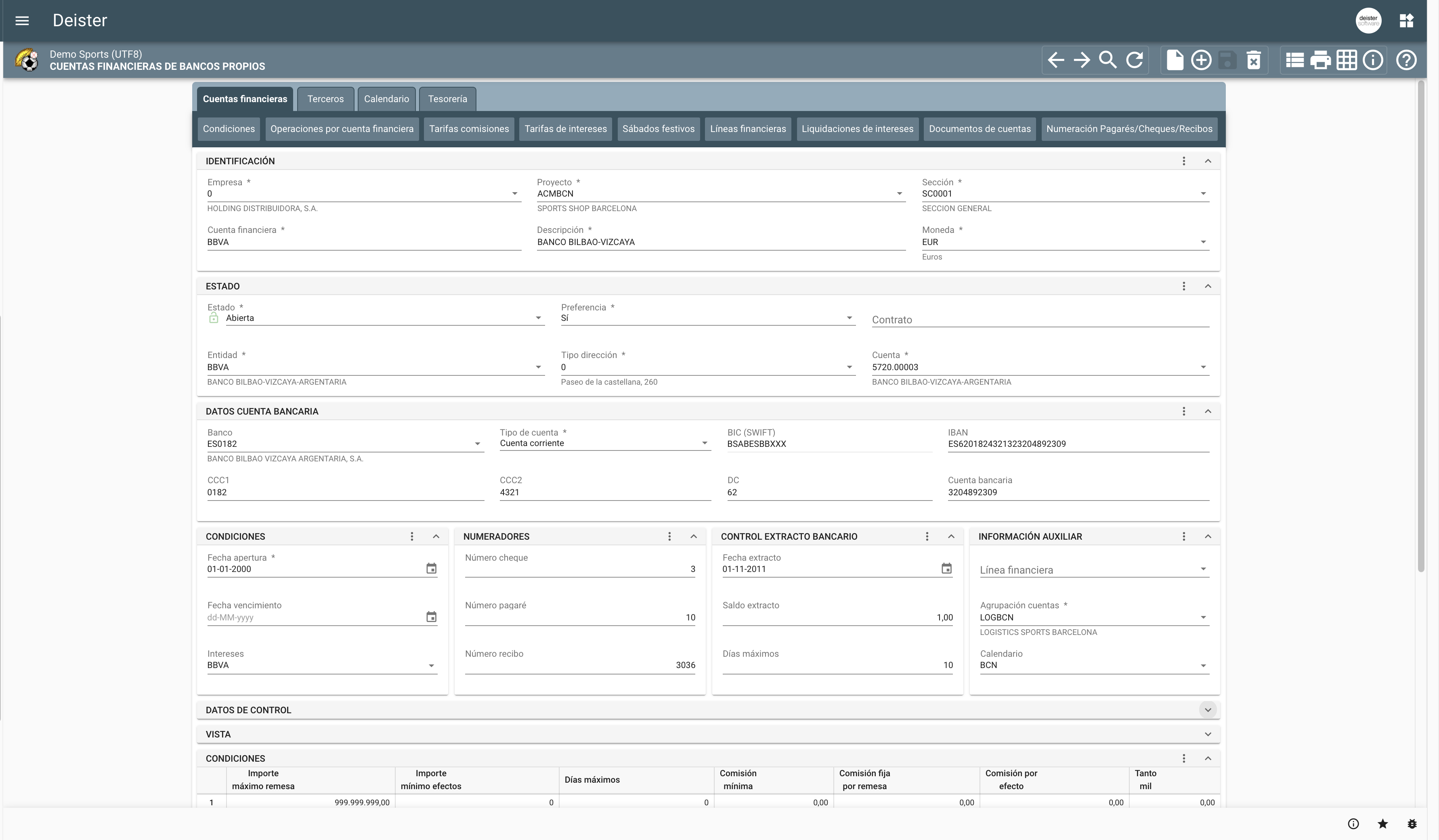

The management of leasing, renting and loan liabilities allows us to introduce all our relevant information and key figures. The system will build out amortization tables for each contract, while various tools will keep them integrated with the central treasury repository.

Each cash commitment can be kept in the original area or added to projected outgoing payments, pending eventual bank reconciliation.

The key features in this module include:

- Amortization tables.

- Interest rate supervision.

- Automated transfer to fixed assets. The Rights Of Use (ROU) within a leasing or renting contract can be connected to a fixed asset in the Assets module of the data model.

- Information analysis tools and reports.

Management of bank guarantees empowers companies to record the principal data for each guarantee and the financial conditions agreed upon. For each guarantee, it is possible to define multiple periods with specific conditions. According to their dates of validity and financial rates, the system provides forecasts of commissions and fees for each guarantee, and also creates linked treasury records, ready to be reconciled against real bank statement data.

Main Characteristics:

- Oversight of requested and granted guarantees.

- Registering and updating of guarantee conditions.

- Generation of forecasted guarantee commissions.

This subsystem allows full management and monitoring of your enterprise’s petty cash. It includes the entry of cash-in or cash-out transactions independently from the general accounting area (but integrated with it at its core), providing a simple way for those responsible for petty cash to keep information current and benefit from the system’s high-level integration. It includes the cash book in addition to the automated accounting of specific transactions.

Among the module’s features, it is especially worth mentioning cash book settlement, control on provisional vouchers and any other collection or payment document, and direct check cashing managed by the cashier.

Cash accounting records are equipped to automatically account for cash collections and payments, allowing you to assign transactions to specific cost centers or investments.

Companies with a high number of cash movements between group companies or between accounts of the same company benefit from having a functionality that allows the information to be registered only once.

Axional ERP/FI-Treasury facilitates transactions between accounts of the same company and between companies of the same group. It allows registering transfer data only once, indicating the input and output parameters, from which short-term forecasts are automatically generated.

In this way, it is avoided to register the information more than once, as well as the risk of errors in data entry, which would later imply a difficulty in the reconciliation and consolidation processes.

The cash subsystem allows the management and control of the company’s cashes. Registration of inflows and outflows, with independence of accounting, providing a simple method by which cash managers and accounting managers benefit from the integration of the system. Includes cash book and automatic accounting of the corresponding notes.

Among multiple functionalities, it allows the daily cash register, the control of provisional vouchers and of any collection or payment document, making it possible to manage the direct collection of checks by the cashier.

The cash register allows the automatic recording of cash receipts and payments, being able to allocate movements to cost centers or investments.

Notable benefits

- Greater efficiency due to core integration with the Axional ERP/FI ACR/ACP portfolio, avoiding repetitive tasks and allowing the automation of most cash flow.

- Maximum control of bank transactions.

- Precise monitoring of liquidity management.

- Productivity enhancement.

- Data integrity and reliability.

Empower your business today

Our team is ready to offer you the best services