Investment management

Investment management

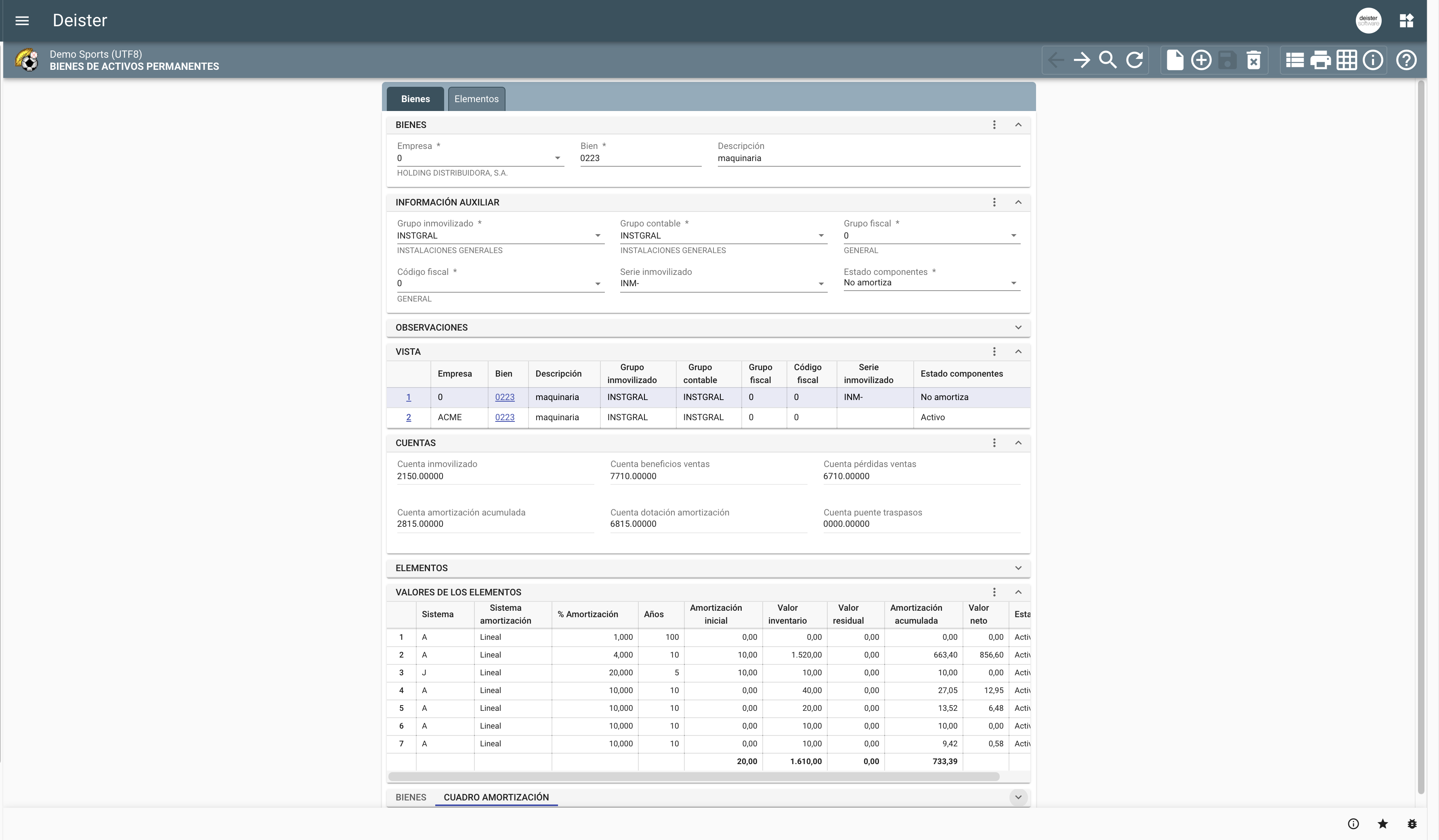

Axional ERP/FI – Investment Management backs the operative management of your capital investments with equity portfolios including stocks in national or international markets, as well as bond portfolios including corporate bonds, government bonds, derivatives, and more.

Our solution provides comprehensive portfolio control and keeps you informed, at all times, about the current status of a portfolio at the level of composition, maturity, overall valuation, valuation by operation, realized and unrealized profits, technical data, and so one. It also factors in portfolio profitability and account profitability, takes over data, like the profit-earning capacity split on portfolio, cash management, opening balance, miscellaneous expenses, dividends, and bank statements.

The main features included in this module are listed below:

- Classification of securities by product, market, sector, etc.

- Control of multiple investment portfolios and securities in different currencies.

- Monitoring of unpaid due dividends, or dividends accrued but not yet due.

- Monitoring of stocks listed in domestic and international markets, bonds and obligations, etc.

- Monitoring of securities listed in international stock markets, incorporating them into portfolios as they are bought and sold.

- Importation and integration of external brokers’ electronic files.

- Commissions and fees included in purchase/sale costs or profitability calculations.

- Partial sales on investments acquired in one or more purchase transactions, updating balance and value.

- Monitoring of interest / dividends received and receivable.

- Up-to-date information on profitability per specific operation.

- FIFO (first in, first out) as default sale method for securities acquired in more than one purchase transaction.

Axional ERP/FI – Investment Management acts as a powerful, easy-to-use tool which makes it affordable to manage and analyze all capital investment operations. Monitoring with full drill down/drill through capabilities boosts company performance, with advanced features described below.

Types of investment operations

Financial investment operations are classified into several typologies:

- Purchase of securities.

- Sale of securities.

- Collection of income.

- Interest payment on fixed-income securities.

- Maturity or depreciation of debt securities.

- Adjustments of investments (impairments, capital gains)

Online information

As soon as new capital investments take place, the system registers essential information and supplies, in real time, a comprehensive view of that investment portfolio, allowing online queries about stock market evolution, pricing, current gap between market price and former purchasing price, and tracking past scenarios, trade operations and transactions.

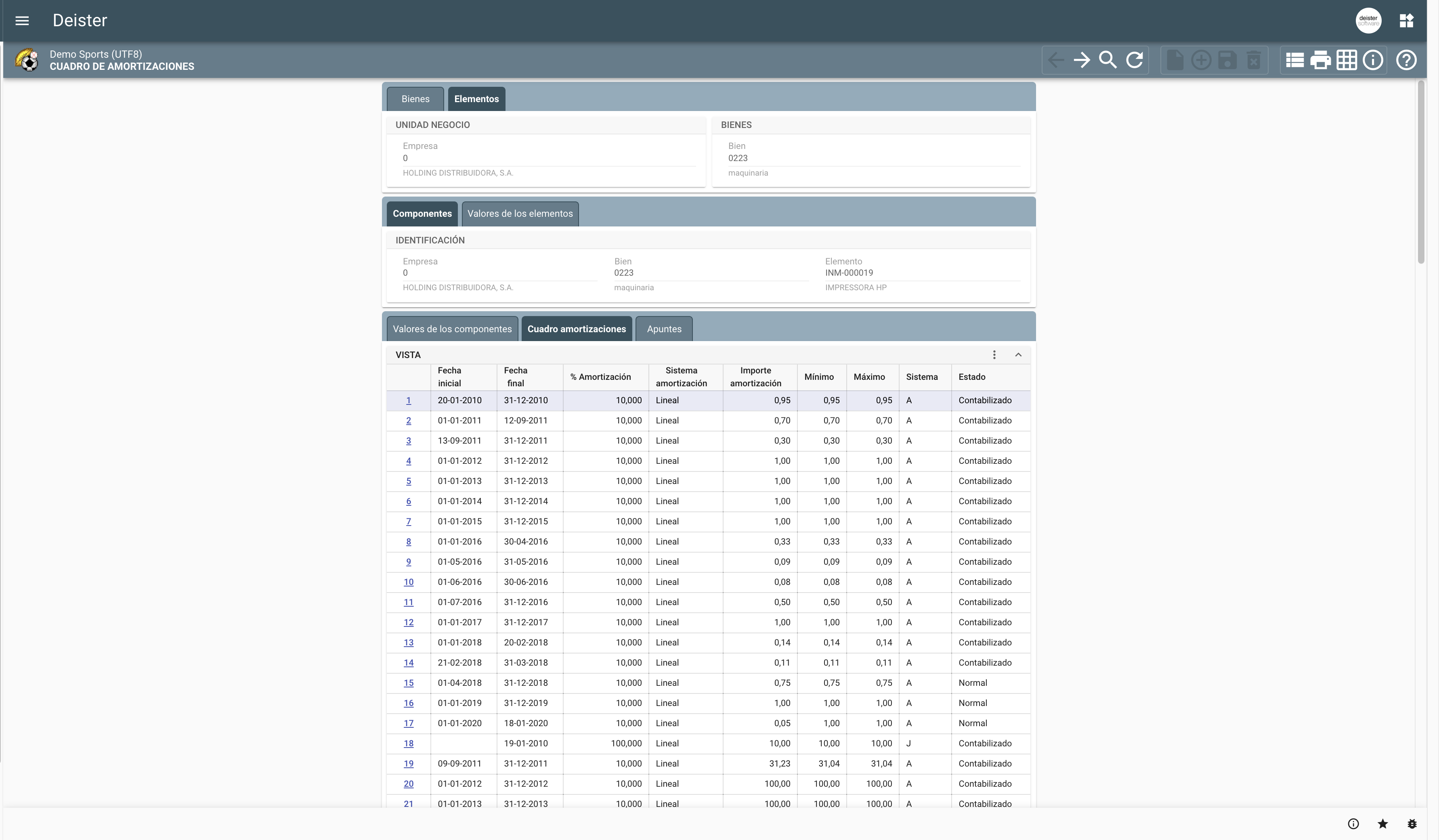

Automation and process rollback

Axional ERP/FI – Investment Management frees your company of the repetitive and time-consuming tasks needed to update portfolios (in terms of valuation, accruals, and yield). These tasks mainly concern avoiding erroneous results and data manipulation when calculating:

- Accrued interest not yet due.

- Past-due interest still pending collection.

- Capital losses due to fluctuations in market price.

- Capital gains and losses due to exchange rate fluctuations.

- Rollback availability.

Companies need not worry if they must reverse a series of actions and processes, as the Axional system allows rollback whenever necessary and feasible according to the company’s management rules.

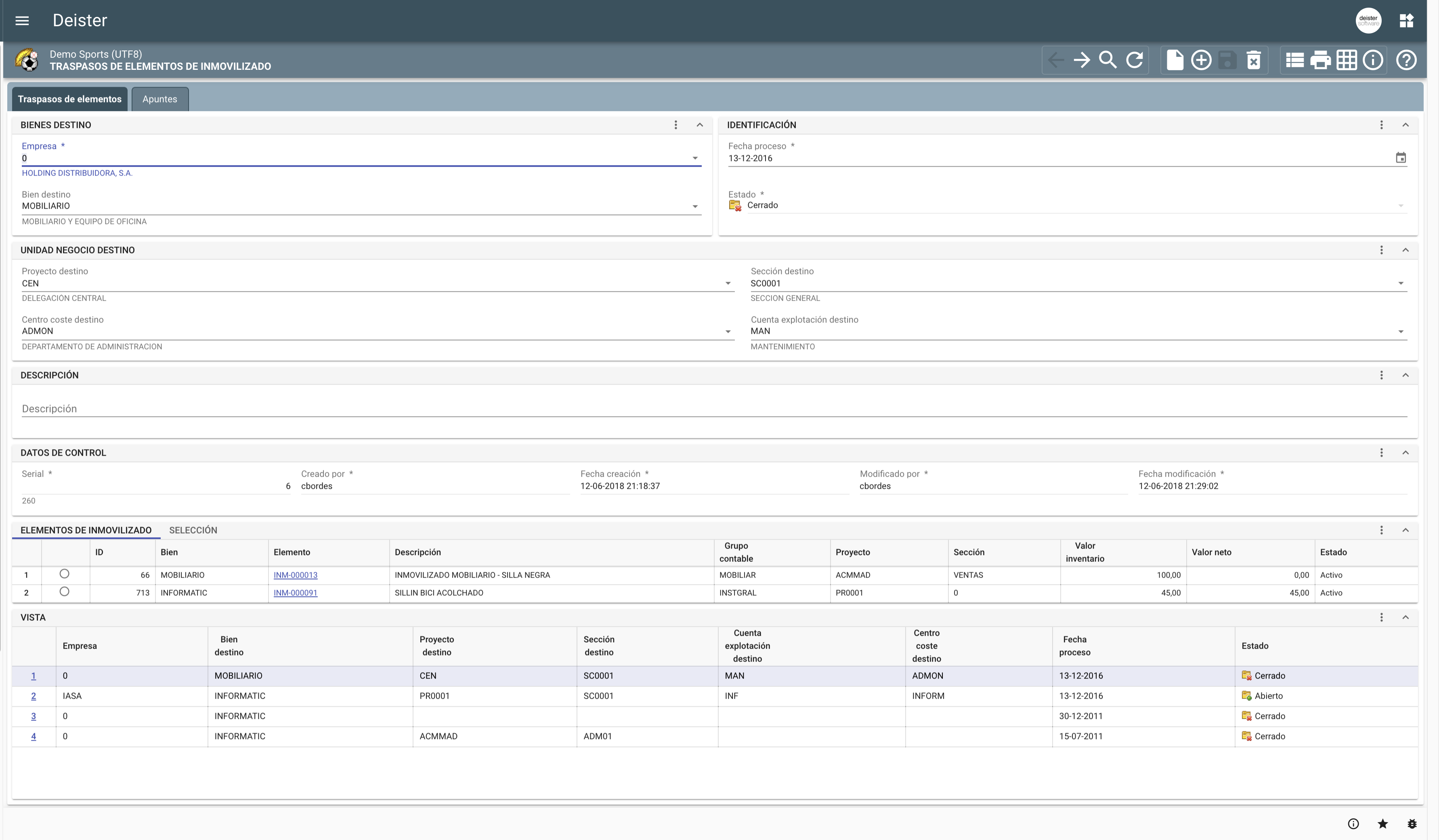

Accounting integration

Automated accounting functionalities are designed to process and deploy accounting entries linked to the purchase and sales of capital investments, interest collection, capital losses, and related transactions. This self-managed bookkeeping provides strong tracking and audit features. Furthermore, they are fully integrated with Axional ERP/Finance – Treasury, which generates forecasted cash flow transactions pending bank reconciliation.

Average cost method

According to specific business rules preset by your company, this optional module defines the method used for each set of portfolio investments in order to calculate their profitability and return on investment. Here, two methods are available: by cost of purchase or by average portfolio cost.

In connection to this approach, if a portfolio utilizes the average cost method, then the system will always keep the portfolio valuation up to date and factor in data from any operation linked to the portfolio.

Reports and information analysis

Increased productivity is the result of the data system adapting itself to users’ needs, offering flexible and rapid tools for information analysis which contribute to decision-making. The investment module includes several reports and layouts, such as:

- Daily portfolio operations statement.

- Portfolio profitability report, detailing figures according to type of operation, security, market, sector, and so on.

- Evolution of quoted prices over selected periods or portfolio subsets.

Notable benefits

- Process automation and rollback. In this sense, the system frees up the investment department, avoiding time-consuming tasks like updating portfolios (in terms of valuation, accruals, and yield), performing calculations for a certain period, and initiating rollback processes. Automating these tasks reduces erroneous results and data manipulation.

- Integrity of information shared between this module and the accounting module. All operations related to purchase and sale of securities, interest charges, capital losses, etc. are recorded automatically in both areas, ensuring integrity and data traceability. The system also leverages strong links with the Axional ERP/FI – Treasury module.

Empower your business today

Our team is ready to offer you the best services