Accounts Receivable / Accounts Payable

Accounts Receivable / Accounts Payable

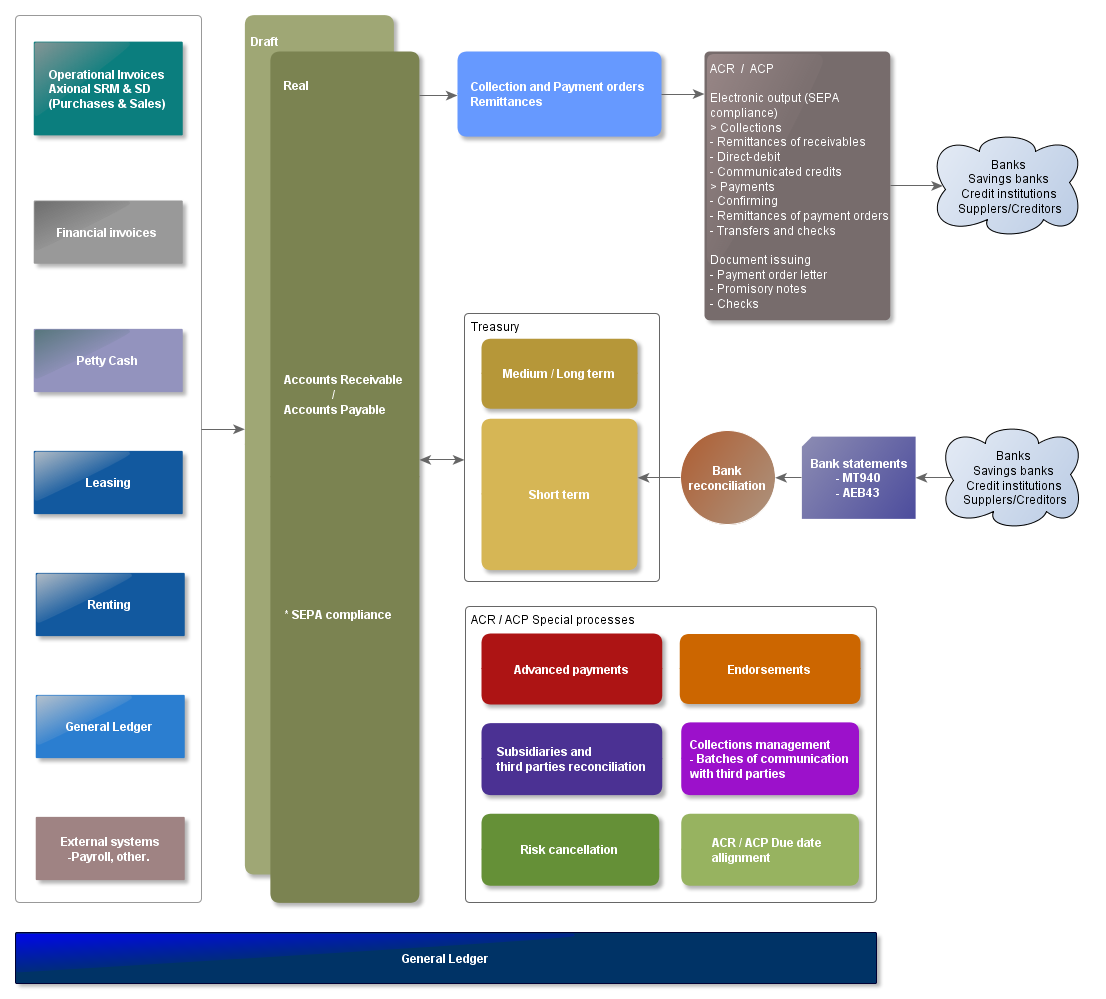

Axional ERP/Finance – ACR / ACP blends sophistication with clear, effortless functionality to simplify all collection and payment processes, helping your organization manage cashflow and decrease debt by improving the cash cycle, shortening approval intervals, and tightening links with both customers and suppliers.

By design, all Axional ERP modules are fully integrated and closely interlinked with one another, ensuring that ACR / ACP information is exact, trustworthy, documented, and ready to be shared when and where necessary. As such, all features are not only focused on efficiency and productivity, but also ensure utter control in this critical area.

Accounts Receivable (ACR) and Accounts Payable (ACP) management is easy to use, simultaneously providing a big-picture overview and detailed insights. It is possible to analyze the history of a specific customer, follow all the steps in the ACR / ACP management process of a specific collection or payment, manage due dates and other critical information, or just browse to the desired extent. Also noteworthy is the oversight of debt renegotiation, partially settled payments or collections, cashflow forecasts, defaults and other issues.

Several activities linked to risk assessment and management are also automated and improved, enhancing the work of both sales and purchases teams and eliminating possible error due to communication barriers between departments.

Companies obtain a wide range of detailed reports on debt status with information such as the age of the debt, past accounts receivable and payable records for each third party (customer, supplier, debtor, creditor), and repayment terms and conditions.

As a brief summary, some key features can be underlined:

- Real-time integration with the accounting area. Each transaction, modification or reallocation, if necessary, generates a corresponding accounting entry.

- Risk management for customers, suppliers and bank entities.

- Batch communication on ACR/ACP status via automated email or fax.

- Issuing of advances.

- Offset of receivables and payables, debt reallocation and segregation of securities.

- Automated ACR/ACP proposals and payments. Electronic signature and authorization functionalities.

- Tracking of collection handled by a third party, including collections in progress.

- Management of consignment and transactions. Control of discount lines.

- Forecast management: forecast reports (cashflow), comparison with past status, risk management.

- Issuing of electronic files under standard banking regulations: CSB 19, 32, 34, Confirming, etc.

- Reconciliation and settlement of bank risk.

- Analysis of past ACR/ACP status on specific dates.

The most relevant Axional ERP/Finance – ACR / ACP functionalities are highlighted below:

Customizable workflows and processes

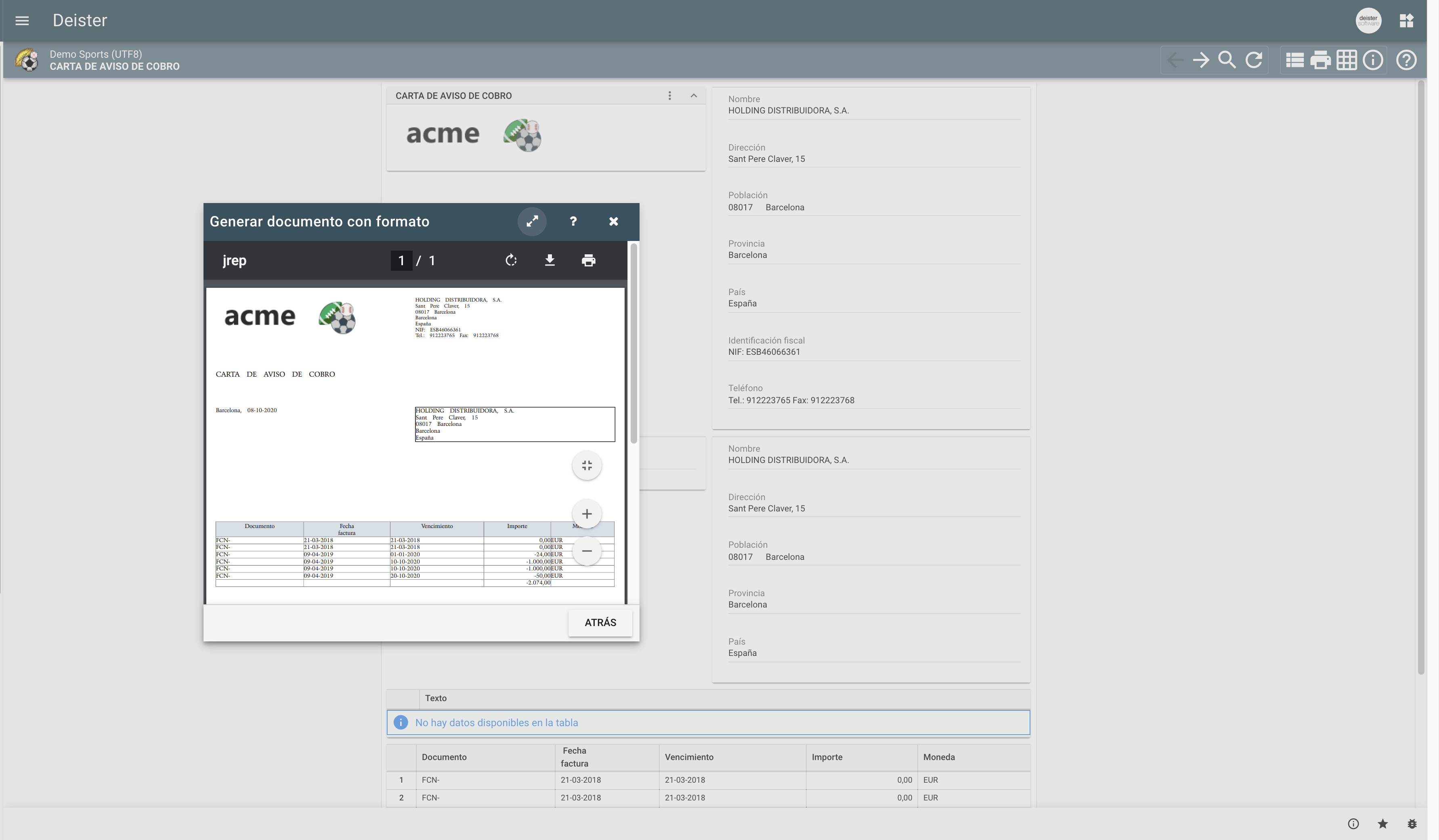

All statuses which a collection or payment document may pass through, based on portfolio administration processes, are configurable by the user. This is also the case for any necessary authorizations, user-specific restrictions, automatized communication, document consignment, and accounting entries.

In this way, Axional ERP/Finance – ACR/ACP adapts itself to all administrative processes linked to accounts receivable and payable. This allows the user to identify each step in various portfolio workflows, via a unified administration master defined by statuses through which a collection or payment document may pass.

Actions are behind each change of status; they constitute the links between different statuses within the ACR / ACP portfolio processes, providing at each step progress from a source status towards a final one.

The actions that enable status changes enhance the flow of the portfolio process, and include the following functionalities:

- Specific handling of securities according to the type of collection or payment.

- Ability to link portfolio status changes with corresponding accounting entries.

- Exchange rate management.

- Management of defaulted payments integrated with Axional ERP/Finance – Treasury.

- Full tracking and rollback capabilities via records of status changes.

The configuration of actions is completely flexible, such that, starting from a given status, the evolution of ACR/ACP may follow a specific path depending on, for instance, the method of collection or payment.

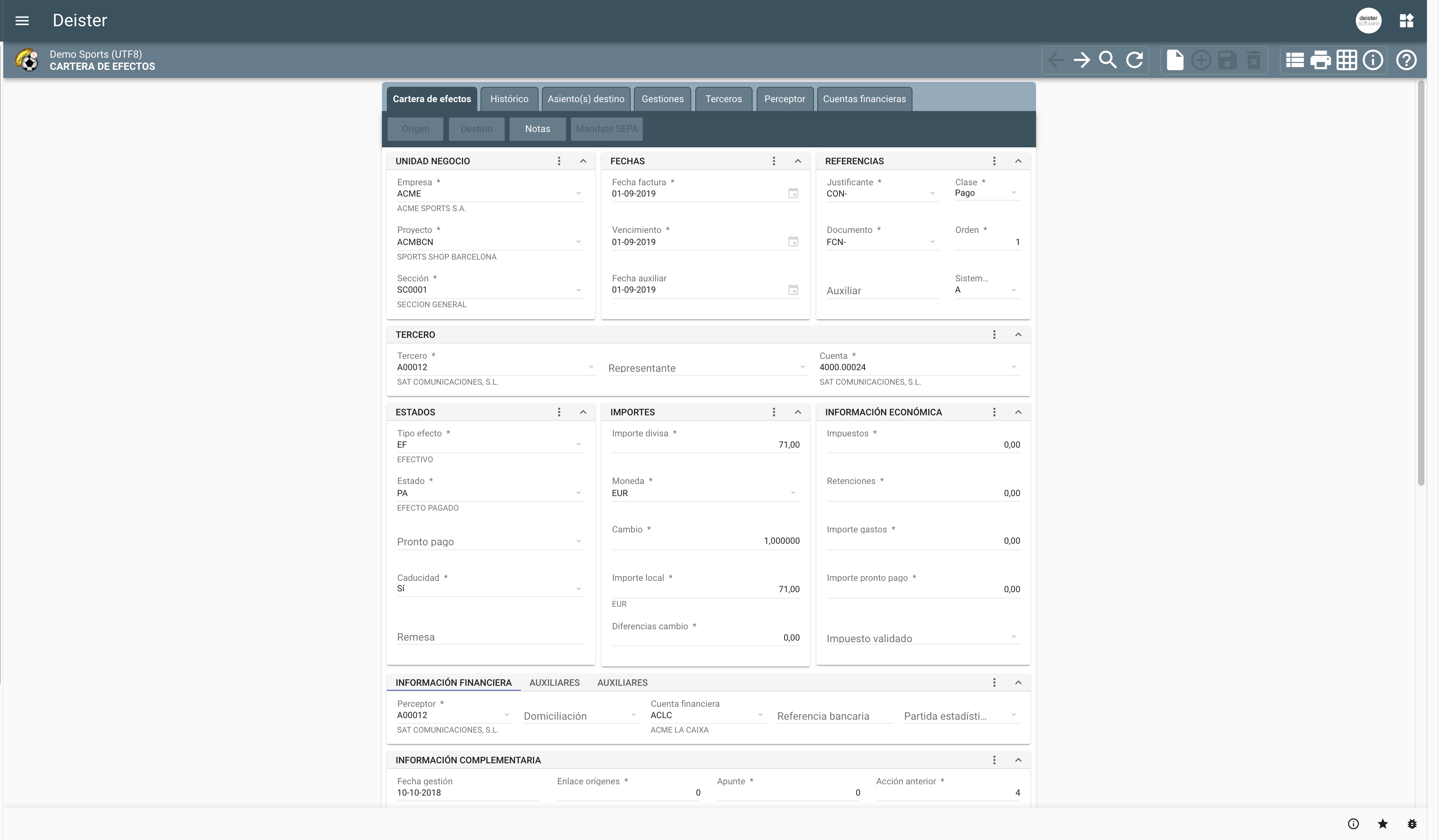

Integration with treasury

Integration with the Treasury module is fully automated and takes into account not only short-term cashflow, but also medium-term cashflow and forecasted projections.

The medium-term treasury provides figures to forecast the status of liquid assets, including pending assets in the ACR / ACP portfolio, documents received or issued but not yet processed, etc. This set of situations can be classified by corresponding portfolio statuses.

For each portfolio status, it is possible to define whether or not it feeds into medium-term cashflow, taking into account: due date, currency amount, form of payment, bank account, and the origin or destination of each collection or payment.

The medium-term treasury is automatically updated according to the evolution of receivables and payables. As soon as these are included in a remittance or collection or payment reminder, they are withdrawn from the medium-term Treasury and placed in the short-term treasury.

Axional ERP/Finance – ACR / ACP is integrated with short-term real cash flow. This approach allows you to not only keep track of the cashflow of each bank account, but also generate outstanding transactions pending settlement with bank statements, integrated through Axional ERP/Finance – Treasury.

In this scenario, the Axional ERP/Finance – ACR / ACP master data setup provides criteria to appropriately create records inside Axional ERP/Finance – Treasury. For instance, it may affect the grouping criteria for a set of notes receivable / notes payable included in a specific kind of remittance, and thus the grouping criteria of the associated short-term cash flow records are aligned with the corresponding bank entity (including recipient, due date, etc.).

Moreover, during bank reconciliation and settlement, the linked ACR/ACP portfolio debts are rolled forward to align status with the banking entity and generate corresponding accounting entries.

Taking advantage of interface templates, automated collection and payment orders, and eventual settlement, the uniformity of business procedures is ensured to avert possible errors.

Risk management

Axional ERP/Finance – ACR / ACP powers the management of risk criteria connected to collections processes, providing the ability to configure which ACR/ACP management statuses and types of collection fall under the domain of risk control.

Also available is a set of reports showing risk allocation and risk structure: risk by bank details, customer, recipient, and exportation risk, including foreign ACR/ACP portfolios in foreign currency.

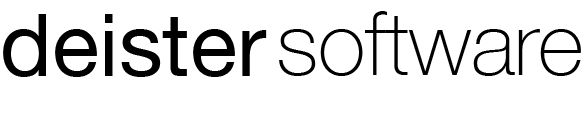

Document issuing and electronic files

Axional ERP/Finance – ACR / ACP delivers several predefined layouts to issue and print:

- Reminder letters and bank payment or collection orders.

- Checks and bank promissory notes.

- Receipts.

Furthermore, this solution also issues electronic files in order to transmit and communicate payment orders, direct debit collection orders, remittances, confirmations, transfers, checks and credit operations.

Specific features

Axional ERP/Finance – ACR / ACP portfolio makes it easy to offset receivables and payables, group debts or divide them. This functionality not only enhances document merging and cohesion, but also allows the user to select a set of collection documents and generate a batch of destination documents.

For instance, it is possible to select three collection debts from one customer and merge them, producing two final liabilities: the first one, a check for 80% of the total amount, and a second, a transfer payment holding the remaining debt amount.

Axional ERP/Finance – ACR / ACP facilitates daily reconciliation and settlement between the portfolio and related entities, managing the collections cycle (branches, subsidiaries, agents, representatives or even business partners).

This reconciliation process on invoiced documents provides consensus amounts to be settled in just one collection or payment, according to each specific settlement.

Axional ERP/Finance – ACR / ACP delivers features to manage active oversight on pending collection. Collection management can record any kind of action or communication to roll forward a set of collection debts which are filed in Management. This entity provides the functionalities listed below:

- Automated issuing of reminder letters detailing outstanding debts to collect.

- Partnership definition between those responsible for collection and customers.

- Classification of actions completed and types of conflicts arising from them.

Axional ERP/Finance – ACR / ACP gives us a flexible easy-to-use process flow to characterize the methods of collection which allow us to identify obligations where the amount due has been collected, but is still susceptible to bank risk. This categorization keeps our outstanding debts collected through banking entities under control.

Furthermore, there is a process to reconcile and cancel this bank risk. Its automated configuration is managed with easy criteria like due date and period of risk (number of days) by method of collection.

Notable benefits

The adaptive and versatile data model behind this module dispenses key advantages and benefits:

- Reduction of unpaid sales.

- Maximum control of liquid asset management and cash flow.

- Data integrity and time and error reduction are all associated with setup and maintenance of this module. All actions taken with the debts in portfolio are trackable, as are the accounting entries made in each action, Treasury module notifications (if applicable), and viewing of the source document that led to the debt.

- Increased productivity.

- Balance between cost effectiveness and successful automated processes.

Empower your business today

Nuestro equipo está listo para ofrecerte los mejores servicios